The Aesthetic Experience

Painting is a visual art, it communicates through sight. Although it may use symbolic elements (images, or other symbolic tokens) as part of its construct, paintings communicative power occurs when it evokes an ‘aesthetic experience’ as a result of the sum total of these constructs in both their visual and conceptual (symbolic) forms. Some will argue that the visual is primary, that form and content are coincident, but in thinking about the aesthetic experience I disagree. I believe that the ‘retinal’ and the ‘conceptual’ coexist in a fashion similar to a quantum state, where both exist simultaneously and it makes little sense to elevate one over the other.

In thinking about how one experiences a painting, I began by analyzing what actually happens as a sequence of events over time. I wanted to make a subtle distinction between what I will describe as the ‘subconscious’ or primordial event and the intuitive event. Some may want to think that this distinction is either not there or unnecessary, I don’t. The process in the order I think it occurs.

The primordial event.

I’m suggesting this is a near instantaneous subconscious form of perception which may be in part genetic, as a form of ‘filtering’ in the brain. There is considerable evidence that visual perception is the result of a processing activity which occurs within the brain. The information, as signals from the retina, is processed into an ‘image’ by the brain. However this happens, the brain does perform certain filtering processes, some of which must have had survival benefits for the species in the past. Some of the filtering operations are designed to enhance our awareness of the environment and some seem to exist to trigger other psychological responses which have had a survival benefit. These processing events are not limited to the human species.

The intuitive event.

If you so desire you can say, my primordial event is something that is ‘intuitive’ It really doesn’t matter because, regardless if you make the distinction or not, what I described as the primordial event happens first. It is the minimum basis for intuition.

‘Intuition’ must occur in the brain. Intuition is described as ‘direct knowledge’ which occurs without ‘conceptualizing’ (the cognitive). An event which occurs ‘without conceptualizing’, that is, without active cognitive thought, must use whatever information is already present in the brain. Since there is no way to get information into the brain other than experience, this would have to include both the primordial and memory directly acquired through ones life experience.

The cognitive event.

This is the active process of thinking, reasoning, remembering, imagining, or learning about what we are seeing. It’s the stuff we talk and think about.

----

Since intuition has no way of occurring without some form of previously acquired knowledge (awareness) in the brain it must be evoked based upon the (prior) knowledge of the viewer. There is no reason why ‘intuition’ need be rational, in fact with little prior experience or because of psychological or neural disorders, it may well not be.

If ones ‘intuition’ can be improved over time, for example by looking at a lot of excellent paintings, then this suggests that the ‘intuitive response’ is indirectly affected by prior memories which were in part the result of cognitive thought and reasoning. If not, then it can only be a result of the primordial response, which I do not think is the case.

While intuition may be ‘the direct knowing’ of something, this does not in fact suggest what one intuits is correct. People have the wrong intuition about things all the time. Again, this would suggest that ‘good intuition’ is partly a result of good training or conditioning of the mind. The longer we work with something, the more intuitive it may become.

In the cognitive process, one may subject a painting to rational (or irrational for that matter) analysis and try to understand ‘why one had such a strong intuitive response’ I would suggest that these cognitive activities add up as (abstracted) memories which provide part of the basis for later ‘intuitive responses’ by reinforcing particular aspects of ones visual responses by repetitive focus.

If my assumptions are correct we can conclude that the ‘intuitive’ experience will be affected by the knowledge of the viewer, what we might call their ‘taste.’ This will have a direct affect on the ‘aesthetic experience,’ their emotional or gut response to a painting. As a result both the visual and cognitive components of a painting combine to produce the aesthetic response. Beauty is more than skin deep.

Saturday, October 28, 2006

Sunday, July 30, 2006

Thoughts on painting - I

All assumptions about the stylistic evolution in painting for the last 100 years are suspect. The idea that there is somehow "progress" in stylistic evolution is false. What one might see as the evolution of painting in the twentieth century, the popular path, Picasso to Pop, is only part of the story. It was built on the idea of the "modern", the constant roiling change of styles leading into the future. It was about the radical social changes brought forth by the industrial revolution. (From my remark in the comments section of the previous post.)

Painting and the Industrial Revolution: "The effects [of the industrial revolution] spread throughout Western Europe and North America during the 19th century, eventually affecting most of the world. The impact of this change on society was enormous and is often compared to the Neolithic revolution, when mankind developed agriculture and gave up its nomadic lifestyle." [Wiki] The Industrial Revolution ushered in the modern age and the shift away from an agricultural to an urban lifestyle. Coincident with this radical social change was the invention of photography which provided an alternative to painting for documentary representation.

No longer confined to strict representation, painting in the Modern era (roughly 1840 on) began to explore other modes of expression, which for lack of a better word I am referring to as "styles". I cannot think of another period in the past where there has been such a rapid and radical evolution of pictorial styles. The modern quest for the "new" resulted in the proliferation and rapid turnover in pictorial styles.

If I can digress for a moment here, I concede that "personal style", the way a painter makes a painting, the trace of the hand, can be unique within certain categorical parameters. This is an important aspect of the work which conveys personal identity. It is not what I am referring to as "style" for this discussion. When I say "style" I mean "cubism" and the like.

Painters who desired to make "advanced work" saw the quest for the "new", the invention of a "different" pictorial style, as the path to follow. So here we are, 160 or so years later and I want to suggest that this course of inquiry cannot logically continue. Because the course of this inquiry is closed, it is a loop. Once someone makes a "stripe painting" it becomes a definition and the stripe paintings which follow are variants and therefore technically not "new".

While I have no doubts that there will continue to be "new styles" I am questioning whether this can continue to occur at the same pace as we proceed further into the new century. Is this quest for "newness", nothing more than just playing "dress up" with painting, reducing it to nothing more than an ever-changing decorative fashion?

Is to be the course for painting for the next 100 years? I don't think so.

Painting and the Industrial Revolution: "The effects [of the industrial revolution] spread throughout Western Europe and North America during the 19th century, eventually affecting most of the world. The impact of this change on society was enormous and is often compared to the Neolithic revolution, when mankind developed agriculture and gave up its nomadic lifestyle." [Wiki] The Industrial Revolution ushered in the modern age and the shift away from an agricultural to an urban lifestyle. Coincident with this radical social change was the invention of photography which provided an alternative to painting for documentary representation.

No longer confined to strict representation, painting in the Modern era (roughly 1840 on) began to explore other modes of expression, which for lack of a better word I am referring to as "styles". I cannot think of another period in the past where there has been such a rapid and radical evolution of pictorial styles. The modern quest for the "new" resulted in the proliferation and rapid turnover in pictorial styles.

If I can digress for a moment here, I concede that "personal style", the way a painter makes a painting, the trace of the hand, can be unique within certain categorical parameters. This is an important aspect of the work which conveys personal identity. It is not what I am referring to as "style" for this discussion. When I say "style" I mean "cubism" and the like.

Painters who desired to make "advanced work" saw the quest for the "new", the invention of a "different" pictorial style, as the path to follow. So here we are, 160 or so years later and I want to suggest that this course of inquiry cannot logically continue. Because the course of this inquiry is closed, it is a loop. Once someone makes a "stripe painting" it becomes a definition and the stripe paintings which follow are variants and therefore technically not "new".

While I have no doubts that there will continue to be "new styles" I am questioning whether this can continue to occur at the same pace as we proceed further into the new century. Is this quest for "newness", nothing more than just playing "dress up" with painting, reducing it to nothing more than an ever-changing decorative fashion?

Is to be the course for painting for the next 100 years? I don't think so.

Wednesday, July 26, 2006

A Call to Arms.

This commentary started off as an answer to a question Ed Winkleman asked in The Lost Lifestyle "What I'm most interested in here is whether a lifestyle has been lost and if so does that matter and if so why?"

I got to thinking about the implications of what he was referring to, in essence the hypothetical loss of the "café society" and what that might mean. If we were sitting at the French Bistro across the street, given a couple of bottles of Bordeaux this is what might have ensued .

The speed of modern life, or maybe it's just the pressure, puts a crimp into the old café-bar society intellectual discussion. The French are very good at this, they will argue a philosophical point just to argue, Americans are more practical, show me the beef, buy or sell, what's the diff? In any case, it is not something which is currently commonplace but that does not mean it cannot exist.

In thinking about it, I believe that what's needed by the culture, is manufactured by the culture to fulfill the need.

Right now, the artworld is obsessed with money and glamour, it want's to be Alleywood, with a small glam audience that fits neatly on the pages of Artforum's blog and the NYC social diary. So, if this is what interests you, you're set, you get what you want.

On the other hand, I have the faint suspicion that something deeper lurks in the dark shadows, or maybe it's something darker lurking in the deep shadows, of this culture.

Why is anyone even reading this? Is there a terrible disconnect between what we believe, what we want for our lives, and the world as we know it? "They" want us to think about the money, about petty desires, maybe we won't notice what is happening.

I am not talking about political action, I could be but I'm not, I'm just thinking that society needs the artist to think a bit more about life and a bit less about success or money.

To realize that this society is sick, it argues it's course with a soundbite.

It argues it's course with a soundbite, and this glib course affects the life or death of someone you do not know. Should that matter?

Does it matter at all what discourse is put forth by the intellectual communities of society, including the artists? What if I suggested that the logical conclusion of postmodern philosophy is George Bush? Oh my God, how can I say that? Easy, just keep bending the truth, reinterpreting the facts as one sees fit, until everyone gives in, which is what has happened.

Where in society must resistance to this madness start? Why among the intellectuals, including the artists, of course.

It is not necessary to arrive at a solution, nor even assert a political action. The problem is apathy, the acceptance of something which you know is wrong in spite of yourself. It is not the responsibility of the artist to change society, in truth this is a course for the politicians.

It is the responsibility of the artists to reveal society as it is, or is not, to speak the unsaid, to think the unthinkable, to reassert the common dialog so that society can steer its own course. If the artist is obsessed with fame and fortune, society will be obsessed with fame and fortune. Gee maybe we are self corrupting, sounds pornographic, shouldn't it be fun?

Life is not simple, societies problems will not succumb to simple solutions, and just because you think something is right does not mean it is. Western free societies, the gift of the Greeks perchance, are based upon debate and consensus.

If society reduces debate to a soundbite we might as well eliminate the body politic and just flip a coin. Debate requires awareness, and awareness requires information, thought and action. How the artist fits into this puzzle is interesting, the artists is not a politician, it is not his or her responsibility to fill the queue with the body politic. It is the artists responsibility to illuminate the nature of debate itself, to affect by action, the process of debate not necessarily its outcome.

The current American problem is that we are told to be afraid of debate, we are afraid of the truth, whatever it might be, we reduce it to a binary option, a soundbite of thought, yay or nay by whatever means necessary. It is the responsibility of the artist to resurrect the debate, to ask the question, take a position, be political, intellectual, hedonistic, shit just be real, we need the truth.

To seek the truth, any truth, is better than repeating a lie.

What I am suggesting here is that the artist functions in society in a way which is psychic and subtle. In a way, the artist gives license to the culture, if we poke ironic fun at societal issues, a wink, wink, nod, nod, masturbation of acceptance, we in essence, deprecate their importance by avoidance.

If art has any meaning at all, any societal function, it is this, art is capable of seeding thought, refocusing perception, changing attitudes, in essence art can provide a subtle model for perceptual change as evidence that such perceptual change is possible. As evidence that such perceptual change is possible, not some political ideology or some philosophical theory, these come and go with the wind, but the idea that humankind must be adaptive in its thought process is a necessarily evolutionary concept which is at the core of the art making process.

It is 2006, six years into the new century, six years into the new millennium and we are debating evolution and the morality of stem cell research. What is wrong with this fucking picture? Oh yea, the body politic is dead against attempts by Islamic conservatives seeking a return to philosophy from middle ages. Oh god, Salem witch hunts would make a great reality TV show, sex, sin and torture for morality. Let's hear it for morality, my morality, my voting morality, my vote, my my. Oh, you say, fuck morality. I say what is the difference? Life is not black and white, as they say "it's in living color", the question is up for debate.

It is 2006, six years into the new century, six years into the new millennium and I think artists have wimped out, "Show me the check, I want mine while the getting is good, I'll be your whore, will you be my pimp?"

It is 2006, six years into the new century, six years into the new millennium and the world is on the verge of blowing itself up. As artists what can we do to affect a psychic change into societies perception of the future?

If you do not have an opinion about this, then you are part of the problem.

I got to thinking about the implications of what he was referring to, in essence the hypothetical loss of the "café society" and what that might mean. If we were sitting at the French Bistro across the street, given a couple of bottles of Bordeaux this is what might have ensued .

The speed of modern life, or maybe it's just the pressure, puts a crimp into the old café-bar society intellectual discussion. The French are very good at this, they will argue a philosophical point just to argue, Americans are more practical, show me the beef, buy or sell, what's the diff? In any case, it is not something which is currently commonplace but that does not mean it cannot exist.

In thinking about it, I believe that what's needed by the culture, is manufactured by the culture to fulfill the need.

Right now, the artworld is obsessed with money and glamour, it want's to be Alleywood, with a small glam audience that fits neatly on the pages of Artforum's blog and the NYC social diary. So, if this is what interests you, you're set, you get what you want.

On the other hand, I have the faint suspicion that something deeper lurks in the dark shadows, or maybe it's something darker lurking in the deep shadows, of this culture.

Why is anyone even reading this? Is there a terrible disconnect between what we believe, what we want for our lives, and the world as we know it? "They" want us to think about the money, about petty desires, maybe we won't notice what is happening.

I am not talking about political action, I could be but I'm not, I'm just thinking that society needs the artist to think a bit more about life and a bit less about success or money.

To realize that this society is sick, it argues it's course with a soundbite.

It argues it's course with a soundbite, and this glib course affects the life or death of someone you do not know. Should that matter?

Does it matter at all what discourse is put forth by the intellectual communities of society, including the artists? What if I suggested that the logical conclusion of postmodern philosophy is George Bush? Oh my God, how can I say that? Easy, just keep bending the truth, reinterpreting the facts as one sees fit, until everyone gives in, which is what has happened.

Where in society must resistance to this madness start? Why among the intellectuals, including the artists, of course.

It is not necessary to arrive at a solution, nor even assert a political action. The problem is apathy, the acceptance of something which you know is wrong in spite of yourself. It is not the responsibility of the artist to change society, in truth this is a course for the politicians.

It is the responsibility of the artists to reveal society as it is, or is not, to speak the unsaid, to think the unthinkable, to reassert the common dialog so that society can steer its own course. If the artist is obsessed with fame and fortune, society will be obsessed with fame and fortune. Gee maybe we are self corrupting, sounds pornographic, shouldn't it be fun?

Life is not simple, societies problems will not succumb to simple solutions, and just because you think something is right does not mean it is. Western free societies, the gift of the Greeks perchance, are based upon debate and consensus.

If society reduces debate to a soundbite we might as well eliminate the body politic and just flip a coin. Debate requires awareness, and awareness requires information, thought and action. How the artist fits into this puzzle is interesting, the artists is not a politician, it is not his or her responsibility to fill the queue with the body politic. It is the artists responsibility to illuminate the nature of debate itself, to affect by action, the process of debate not necessarily its outcome.

The current American problem is that we are told to be afraid of debate, we are afraid of the truth, whatever it might be, we reduce it to a binary option, a soundbite of thought, yay or nay by whatever means necessary. It is the responsibility of the artist to resurrect the debate, to ask the question, take a position, be political, intellectual, hedonistic, shit just be real, we need the truth.

To seek the truth, any truth, is better than repeating a lie.

What I am suggesting here is that the artist functions in society in a way which is psychic and subtle. In a way, the artist gives license to the culture, if we poke ironic fun at societal issues, a wink, wink, nod, nod, masturbation of acceptance, we in essence, deprecate their importance by avoidance.

If art has any meaning at all, any societal function, it is this, art is capable of seeding thought, refocusing perception, changing attitudes, in essence art can provide a subtle model for perceptual change as evidence that such perceptual change is possible. As evidence that such perceptual change is possible, not some political ideology or some philosophical theory, these come and go with the wind, but the idea that humankind must be adaptive in its thought process is a necessarily evolutionary concept which is at the core of the art making process.

It is 2006, six years into the new century, six years into the new millennium and we are debating evolution and the morality of stem cell research. What is wrong with this fucking picture? Oh yea, the body politic is dead against attempts by Islamic conservatives seeking a return to philosophy from middle ages. Oh god, Salem witch hunts would make a great reality TV show, sex, sin and torture for morality. Let's hear it for morality, my morality, my voting morality, my vote, my my. Oh, you say, fuck morality. I say what is the difference? Life is not black and white, as they say "it's in living color", the question is up for debate.

It is 2006, six years into the new century, six years into the new millennium and I think artists have wimped out, "Show me the check, I want mine while the getting is good, I'll be your whore, will you be my pimp?"

It is 2006, six years into the new century, six years into the new millennium and the world is on the verge of blowing itself up. As artists what can we do to affect a psychic change into societies perception of the future?

If you do not have an opinion about this, then you are part of the problem.

Saturday, June 24, 2006

Reminiscing over the "good old day's."

The art market's preference for young artists has been a recent topic on a couple of other art blogs. Edward Winkleman has an open thread, Hatin' how they love them Youngins and Lisa Hunter has picked the theme up on The Intrepid Art Collector blog with Deja vu all over again.

I started to respond to Lisa's remark "... doesn't anyone besides me remember the 80s? It was the same when we were 20. Jean-Michel Basquiat, Keith Haring, Jeff Koons -- they were all in their 20s when they got famous…" but my thoughts rambled on to long for a comment.

(Lisa) You're right with the personalities, this was true also in the 60's Johns, Rauschenberg, Stella, Poons were all young as well. It might be generational. Typically artists near the age of 30 are the ones making the waves, setting the new stylistic trends. There are some big differences in how the art educational system and the business of art itself has changed over the last 40 years.

In the 1960's, the idea of being an artist as a "career" didn't really exist. By "career" I mean something akin to being a engineer at IBM, or an accountant, where if you got a college degree, you would get a job and a rung somewhere on the corporate ladder. By contrast, art schools, including the few universities which even had an MFA program, primarily taught art fundamentals and art history, the techniques of the trade, any mention of survival after graduation was anecdotal.

In the 1980's, partly as a result of the success of Minimalism, POP Art and Conceptual art, along with the appearance of new magazines like ArtForum, young artists came out of art schools with some idea that being an artist was a career. I think that in the mid 70's some of the art schools at least made an informal attempt to educate their students on what they should do to enter the system. That if you did the "right things" and made decent work, you could get a job (gallery) or even dream of being on the cover of ArtForum.

Fast forward, at the present, in addition to art fundamentals, the art schools also cover, either directly or indirectly, topics more directly related to establishing an art career including "art theory". The MFA has become a variant of the MBA and the "best students" from the "best schools" will get the "best jobs" This appears to be currently true.

The second major difference concerns the art business itself.

In the post WWII period, starting in the 1950's, with the shift in focus from Paris to the US (New York), the art business has grown substantially. Each of the three periods I outlined above, was marked by an increasing amount of capital purchasing "new art" As this trend developed, it became apparent that there could be a substantial return on investment if a collector purchased the early work of an artist who later became prominent. (hot)

This may seem like an obvious conclusion but it is not quite the case. In Los Angeles in the 1960's, the Irving Blum Gallery gave Andy Warhol his first exhibition of the Soup Cans. I think a few were slated to be sold (at around a $100 each but I could be wrong about that) when Mr. Blum decided that the set of 30 (??) paintings should be kept together and bought them himself. In essence he became a collector rather than a dealer. A collector, not a speculator, for he held the paintings for at least 30 years (I vaguely recall they may have finally been donated to a museum, I'm not sure)

The 1980's saw the birth of the art speculator, as a class of clientele, and the use of the "auction" as a method of establishing or raising prices. Prices of "emerging artists" were "augmented" through the auction market. Artworks were bought from an artist or dealer, sometimes by 2-3 people who each owned a "share", put up for auction and bought back by another collector who wanted the "unavailable" work, obviously pricing took a big jump and the "art speculator" was born.

A rising price has an interesting psychological affect, it creates demand. In the late 1970's, Phillip Guston's dealer could not sell his late new paintings (the ones people today love) at a price of $10,000. Even though they were great paintings, it seems that there was not much interest, collectors wanted paintings in his "established style". On day, his dealer told him over the phone, "Phillip, I've just doubled the value of your inventory" and doubled the asking (retail) prices, the rest is history.

At the present, none of the above observations have been lost on either side. Young artists are taught/encouraged to develop "a body of work" and the means of marketing it as a product. (there is a wide ranging definition for the word "product") As long as the art market stays firm, the speculators are prepared to take advantage of the situation by snapping up the work presumably with the intent of selling it later.

The fact that artists have become careerist, in the corporate sense, helps reduce the purchase risk. I suspect that, in a hot market for an artist, access to the work becomes somewhat constrained and is afforded to the "best clients". Again this is not unusual, with the exception that the speculators have a decided interest in seeing prices appreciate and may help things along where possible.

I suppose one should view this as a win-win situation for all concerned, the gallery, the collector, the speculator and of course the artist. On the consumer end, I believe this is true a good art market and appreciating prices is beneficial. For the artist, I suspect it may be a double edge sword. On the one hand, for artists with a degree of emotional maturity, the financial success may allow them more time to develop their artwork, more time to experiment and confidence, which should not to be underestimated as a developmental force. On the other hand, the pressures of financial success may weigh on the young artist by creating constraints, stylistic and otherwise, for which they are not prepared.

Whatever, it is what it is. As long as the art market stays firm, good or bad, I suspect the situation will continue. Further, an historical precedent has been set, and even if the art market crashed, the situation will be the same when it arises from the ashes again.

Today is some young persons "good old days"

I started to respond to Lisa's remark "... doesn't anyone besides me remember the 80s? It was the same when we were 20. Jean-Michel Basquiat, Keith Haring, Jeff Koons -- they were all in their 20s when they got famous…" but my thoughts rambled on to long for a comment.

(Lisa) You're right with the personalities, this was true also in the 60's Johns, Rauschenberg, Stella, Poons were all young as well. It might be generational. Typically artists near the age of 30 are the ones making the waves, setting the new stylistic trends. There are some big differences in how the art educational system and the business of art itself has changed over the last 40 years.

In the 1960's, the idea of being an artist as a "career" didn't really exist. By "career" I mean something akin to being a engineer at IBM, or an accountant, where if you got a college degree, you would get a job and a rung somewhere on the corporate ladder. By contrast, art schools, including the few universities which even had an MFA program, primarily taught art fundamentals and art history, the techniques of the trade, any mention of survival after graduation was anecdotal.

In the 1980's, partly as a result of the success of Minimalism, POP Art and Conceptual art, along with the appearance of new magazines like ArtForum, young artists came out of art schools with some idea that being an artist was a career. I think that in the mid 70's some of the art schools at least made an informal attempt to educate their students on what they should do to enter the system. That if you did the "right things" and made decent work, you could get a job (gallery) or even dream of being on the cover of ArtForum.

Fast forward, at the present, in addition to art fundamentals, the art schools also cover, either directly or indirectly, topics more directly related to establishing an art career including "art theory". The MFA has become a variant of the MBA and the "best students" from the "best schools" will get the "best jobs" This appears to be currently true.

The second major difference concerns the art business itself.

In the post WWII period, starting in the 1950's, with the shift in focus from Paris to the US (New York), the art business has grown substantially. Each of the three periods I outlined above, was marked by an increasing amount of capital purchasing "new art" As this trend developed, it became apparent that there could be a substantial return on investment if a collector purchased the early work of an artist who later became prominent. (hot)

This may seem like an obvious conclusion but it is not quite the case. In Los Angeles in the 1960's, the Irving Blum Gallery gave Andy Warhol his first exhibition of the Soup Cans. I think a few were slated to be sold (at around a $100 each but I could be wrong about that) when Mr. Blum decided that the set of 30 (??) paintings should be kept together and bought them himself. In essence he became a collector rather than a dealer. A collector, not a speculator, for he held the paintings for at least 30 years (I vaguely recall they may have finally been donated to a museum, I'm not sure)

The 1980's saw the birth of the art speculator, as a class of clientele, and the use of the "auction" as a method of establishing or raising prices. Prices of "emerging artists" were "augmented" through the auction market. Artworks were bought from an artist or dealer, sometimes by 2-3 people who each owned a "share", put up for auction and bought back by another collector who wanted the "unavailable" work, obviously pricing took a big jump and the "art speculator" was born.

A rising price has an interesting psychological affect, it creates demand. In the late 1970's, Phillip Guston's dealer could not sell his late new paintings (the ones people today love) at a price of $10,000. Even though they were great paintings, it seems that there was not much interest, collectors wanted paintings in his "established style". On day, his dealer told him over the phone, "Phillip, I've just doubled the value of your inventory" and doubled the asking (retail) prices, the rest is history.

At the present, none of the above observations have been lost on either side. Young artists are taught/encouraged to develop "a body of work" and the means of marketing it as a product. (there is a wide ranging definition for the word "product") As long as the art market stays firm, the speculators are prepared to take advantage of the situation by snapping up the work presumably with the intent of selling it later.

The fact that artists have become careerist, in the corporate sense, helps reduce the purchase risk. I suspect that, in a hot market for an artist, access to the work becomes somewhat constrained and is afforded to the "best clients". Again this is not unusual, with the exception that the speculators have a decided interest in seeing prices appreciate and may help things along where possible.

I suppose one should view this as a win-win situation for all concerned, the gallery, the collector, the speculator and of course the artist. On the consumer end, I believe this is true a good art market and appreciating prices is beneficial. For the artist, I suspect it may be a double edge sword. On the one hand, for artists with a degree of emotional maturity, the financial success may allow them more time to develop their artwork, more time to experiment and confidence, which should not to be underestimated as a developmental force. On the other hand, the pressures of financial success may weigh on the young artist by creating constraints, stylistic and otherwise, for which they are not prepared.

Whatever, it is what it is. As long as the art market stays firm, good or bad, I suspect the situation will continue. Further, an historical precedent has been set, and even if the art market crashed, the situation will be the same when it arises from the ashes again.

Today is some young persons "good old days"

Wednesday, June 21, 2006

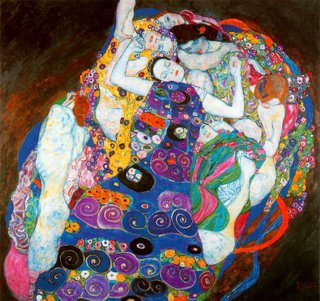

More Gustav Klimt

After the making the previous post, I thought it might be interesting to take a further look at some of Klimt's work. The stylistic focus on line and patterning made me think of the Dubuffet paintings I saw recently at Pace Gallery. Also at the time these paintings were made, the Japanese print had become to the forefront. In my view, Klimt took something from this but made it more uniquely personal.

It also occurred to me that at the moment the zeitgeist favors paintings which are have complicated linear detail. While Klimt may be dismissed by some as "decorative" there seems to be something here worth investigating, I'll append more to this commentary after I think about it awhile.

It also occurred to me that at the moment the zeitgeist favors paintings which are have complicated linear detail. While Klimt may be dismissed by some as "decorative" there seems to be something here worth investigating, I'll append more to this commentary after I think about it awhile.

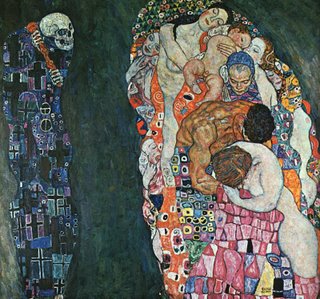

Gustave Klimt, Austria. (1862-1918)

1913, The Maiden (Virgin)

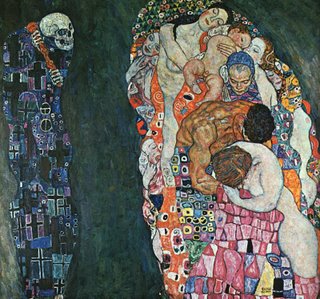

Gustave Klimt, 1916,

Death and Life

In 1918 the "Spanish Flu" Influenza (1916-1918) becomes pandemic; over twenty-five million people die in the following six months (almost twice the number that died during World War I which was also raging at the time).

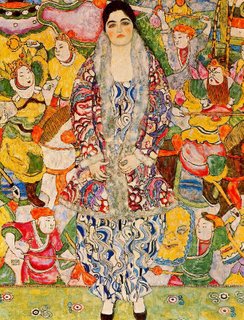

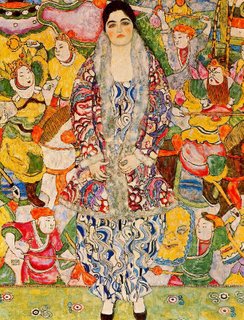

Gustave Klimt, 1916,

Portrait of Friedericke Maria Beer

Gustave Klimt, 1916,

Garden Path with Chickens

Monday, June 19, 2006

Gustav Klimt sets record

"A dazzling gold-flecked 1907 portrait by Gustav Klimt has been purchased for the Neue Galerie in Manhattan by the cosmetics magnate Ronald S. Lauder for $135 million, the highest sum ever paid for a painting."

From the New York Times, Monday June 19, 2006)

Some historical background from the Los Angeles County Museum including pictures of the other four paintings mentioned in the NY Times article

From the New York Times, Monday June 19, 2006)

Gustav Klimt, "Portrait of Adele Bloch-Bauer I" 1907,

Oil and gold on canvas 138 x 138 cm

Photo NY Times.

A different photograph of the same painting.

Photo art Archive.

Some historical background from the Los Angeles County Museum including pictures of the other four paintings mentioned in the NY Times article

Sunday, June 11, 2006

Nicole Eisenman at Leo Konig

Nicole Eisenman's new painting, Progress: Real and Imagined is heroic, both operatic in scope and monumental in scale. The best painting of the 2006 season.

Closes: June 17th, 2006

I went to Nicole Eisenman's opening, outside of reproductions, it was the first time had actually seen any of her work. While I was impressed with the scale of her new painting, it was hard to see because of the crowd. When I left, I wasn't sure what I thought of it. The memory of Progress: Real and Imagined stayed with me, like a gnawing in ones stomach, and I went back to see it again three more times. After my second viewing I knew I wanted to write something about it, but it took awhile to compose my thoughts.

Progress: Real and Imagined is a monumental painting, overall it is 8 feet high by 30 feet wide. It was painted on two canvases, the left is 16 feet wide and the right is shorter at just 14 feet, with a slight separation between the two. Generally, contemporary paintings of this scale, can be organized either as a permutative repetition of a conceptual idea which then becomes a pattern, as a visual field like Monet's Water Lilies, as the result of a physical process like pouring 20 gallons of paint on a canvas, or just by scaling the concept up. Eisenman's approach is none of the above.

I viewed her painting again Saturday with a friend, another painter who admittedly had some difficulty with the work, but who also conceded that it was masterfully organized. I became curious whether this was just brilliantly intuitive, like Jean Michel Basquiat, or the result of an application of a more arcane geometry. What I found was that it is classically organized, referring back to the methods of the Renaissance. Eisenman uses a sequences of divisions, diagonals and the golden section, somewhat like the diagram I posted earlier on Fra Angelico as a scaffold for her paintings flood of images. A painting, with as complex aggregation of images like "Progress: Real and Imagined", requires a degree of organization which creates a visual resonance among its parts or it will fragment into chaos.

Initially I thought there might be some similarity of approach between Eisenman's painting and the paintings of Basquiat and Dubuffet. I mused over the speculation that all three used a "stream of consciousness" approach in creating their works. With Eisenman, this may be the case but discovering the underlying geometric structure of her painting, along with her more deliberate approach to realizing her imagery, leads me to believe it is more of an extension of the approach of these two artists than a direct similarity.

Another factor engendered by the large scale is time. Without knowing for a fact, I suspect "Progress: Real and Imagined" must have taken close to a year to realize. Since this painting is not a repetition of sequential permutations but rather an aggregation of images, the time spent in its execution probably had an affect on the development of the paintings imagery.

A little digression, that afternoon, I also saw Jenney Holtzer's exhibition "Archive" at Cheim & Read. The Saturday crowd of viewers were dutifully arrayed, necks craned, reading the text of the paintings. This struck me as somewhat odd, but there was text to be read and they did.

I also observed how the viewers looked at Eisenman's painting. Since there is nothing to be read sequentially, the dance was different, eyes darted as they walked along, back and forth, in front of the painting. I believe painting is a language, what do viewers see when they cannot read something? The viewer is compelled to reconcile an image, or sequences of images, to imply or decode meaning. A painting is a "random access" visual experience, imagery can be perceived non-sequentially without the structure of a grammar and is processed differently. The eye-brain decodes a gestalt, three dots and a line might be a face, and then proceeds with a cascade on finer distinctions which may eventually be classified linguistically. This also evokes the viewers experience and memory about images, about painting, other images and other experiences. It is a more fluid and complex process than just decoding a word.

Eisenman's imagery can frequently be raw, grating, horrific, disturbing, sexual and not always ingratiating for the viewer. When confronted with the complexity of a painting like "Progress: Real and Imagined", the viewer may suffer overload or the anxiety of interpretation. It is this anxiety which creates the emotional tension, is there progress? Is it real or imagined?

Reading from right to left, we scan from the caveman to the artist in the studio, is this progress? Or not, since reading in the more familiar mode from left to right, goes the other way encountering the more brutal signs of a throwback, a decapitated head and a severed foot. During the paintings gestation period, the news was flooded with stories of a continuing war, of atrocities, natural disasters and corruption. Paintings have a mind of their own, once started they take the artist in a direction, and either subconsciously or by intent, life events become part of the process. This is in part what I was referring to above about how the time affects the imagery of the painting. Is that just a vase with flowers in the center of the painting, or is it some dreadful fireworks from a bomb which just killed a family? This kind of recursive interpretation, could go on for hours, the painting is an sheaf of images capable of constantly unfolding to engage the viewer.

One final observation. "Progress: Real and Imagined" is also complex in its stylistic resolution. Eisenman's painting, firmly structured, runs the stylistic gauntlet from the sweeping to the intimate. The little "throwaway" pictures in the studio are fully resolved in their own right. Her painterliness traverses a range from cursory to crusty congealed passages. It is obvious these variations are by choice, not constraint, for her observational powers are keen as seen in the rendering of the jeans of the artist at work. By expanding her range of execution, she in effect, detaches it from "style" and allows it to function as a tool of expression.

Nicole Eisenman's painting, Progress: Real and Imagined is an ambitious statement, an expansion of her vision. It is the type of painting I was hoping to see at the start of a new century, it is Future Modern.

PS:

I wanted to extend a special thanks to James Wagner and Barry Hoggard for introducing me to the artist.

Closes: June 17th, 2006

I went to Nicole Eisenman's opening, outside of reproductions, it was the first time had actually seen any of her work. While I was impressed with the scale of her new painting, it was hard to see because of the crowd. When I left, I wasn't sure what I thought of it. The memory of Progress: Real and Imagined stayed with me, like a gnawing in ones stomach, and I went back to see it again three more times. After my second viewing I knew I wanted to write something about it, but it took awhile to compose my thoughts.

Nicole Eisenman,“Progress: Real and Imagined”

Oil on canvas, 96 inches x 360 inches

Progress: Real and Imagined is a monumental painting, overall it is 8 feet high by 30 feet wide. It was painted on two canvases, the left is 16 feet wide and the right is shorter at just 14 feet, with a slight separation between the two. Generally, contemporary paintings of this scale, can be organized either as a permutative repetition of a conceptual idea which then becomes a pattern, as a visual field like Monet's Water Lilies, as the result of a physical process like pouring 20 gallons of paint on a canvas, or just by scaling the concept up. Eisenman's approach is none of the above.

I viewed her painting again Saturday with a friend, another painter who admittedly had some difficulty with the work, but who also conceded that it was masterfully organized. I became curious whether this was just brilliantly intuitive, like Jean Michel Basquiat, or the result of an application of a more arcane geometry. What I found was that it is classically organized, referring back to the methods of the Renaissance. Eisenman uses a sequences of divisions, diagonals and the golden section, somewhat like the diagram I posted earlier on Fra Angelico as a scaffold for her paintings flood of images. A painting, with as complex aggregation of images like "Progress: Real and Imagined", requires a degree of organization which creates a visual resonance among its parts or it will fragment into chaos.

Initially I thought there might be some similarity of approach between Eisenman's painting and the paintings of Basquiat and Dubuffet. I mused over the speculation that all three used a "stream of consciousness" approach in creating their works. With Eisenman, this may be the case but discovering the underlying geometric structure of her painting, along with her more deliberate approach to realizing her imagery, leads me to believe it is more of an extension of the approach of these two artists than a direct similarity.

Another factor engendered by the large scale is time. Without knowing for a fact, I suspect "Progress: Real and Imagined" must have taken close to a year to realize. Since this painting is not a repetition of sequential permutations but rather an aggregation of images, the time spent in its execution probably had an affect on the development of the paintings imagery.

A little digression, that afternoon, I also saw Jenney Holtzer's exhibition "Archive" at Cheim & Read. The Saturday crowd of viewers were dutifully arrayed, necks craned, reading the text of the paintings. This struck me as somewhat odd, but there was text to be read and they did.

I also observed how the viewers looked at Eisenman's painting. Since there is nothing to be read sequentially, the dance was different, eyes darted as they walked along, back and forth, in front of the painting. I believe painting is a language, what do viewers see when they cannot read something? The viewer is compelled to reconcile an image, or sequences of images, to imply or decode meaning. A painting is a "random access" visual experience, imagery can be perceived non-sequentially without the structure of a grammar and is processed differently. The eye-brain decodes a gestalt, three dots and a line might be a face, and then proceeds with a cascade on finer distinctions which may eventually be classified linguistically. This also evokes the viewers experience and memory about images, about painting, other images and other experiences. It is a more fluid and complex process than just decoding a word.

Eisenman's imagery can frequently be raw, grating, horrific, disturbing, sexual and not always ingratiating for the viewer. When confronted with the complexity of a painting like "Progress: Real and Imagined", the viewer may suffer overload or the anxiety of interpretation. It is this anxiety which creates the emotional tension, is there progress? Is it real or imagined?

Reading from right to left, we scan from the caveman to the artist in the studio, is this progress? Or not, since reading in the more familiar mode from left to right, goes the other way encountering the more brutal signs of a throwback, a decapitated head and a severed foot. During the paintings gestation period, the news was flooded with stories of a continuing war, of atrocities, natural disasters and corruption. Paintings have a mind of their own, once started they take the artist in a direction, and either subconsciously or by intent, life events become part of the process. This is in part what I was referring to above about how the time affects the imagery of the painting. Is that just a vase with flowers in the center of the painting, or is it some dreadful fireworks from a bomb which just killed a family? This kind of recursive interpretation, could go on for hours, the painting is an sheaf of images capable of constantly unfolding to engage the viewer.

One final observation. "Progress: Real and Imagined" is also complex in its stylistic resolution. Eisenman's painting, firmly structured, runs the stylistic gauntlet from the sweeping to the intimate. The little "throwaway" pictures in the studio are fully resolved in their own right. Her painterliness traverses a range from cursory to crusty congealed passages. It is obvious these variations are by choice, not constraint, for her observational powers are keen as seen in the rendering of the jeans of the artist at work. By expanding her range of execution, she in effect, detaches it from "style" and allows it to function as a tool of expression.

Nicole Eisenman's painting, Progress: Real and Imagined is an ambitious statement, an expansion of her vision. It is the type of painting I was hoping to see at the start of a new century, it is Future Modern.

Nicole Eisenman "Untitled" 2006

Oil on Canvas, 18 inches x 14 inches

All photos from the Leo Konig Gallery website, used without permission

PS:

I wanted to extend a special thanks to James Wagner and Barry Hoggard for introducing me to the artist.

Saturday, May 13, 2006

Dubuffet and Basquiat at Pace Wildenstein

Pace Wildenstein has a wonderful exhibition of paintings Dubuffet and Basquiat: Personal Histories on view at the 25th Street gallery through June 17, 2006. It is a remarkable pairing of two artists of different generations with a surprisingly similar approach to image making, painting. The Dubuffet's from the mid 70's, are great paintings. Don't miss this show.

Jean Dubuffet "Mêle moments", 1976

Mixed media on canvas 98 x 142" (248.9 x 360.7 cm)

Jean Dubuffet "Les lieux conjugés", 1976

Acrylic and paper collage on canvas 97-1/2" x 98" (248 cm x 249 cm)

Jean Dubuffet Panorama, January 20, 1978

Acrylic and paper collage on canvas 82-1/2" x 111-1/2" (209.6 cm x 283.2 cm)

Jean Dubuffet La féconde journée, 1976

Acrylic and paper collage on canvas 80-1/2" x 83" (204.5 cm x 210.8 cm)

All images are from the Pace Wildenstein website and used without permission.

Jean Dubuffet "Mêle moments", 1976

Mixed media on canvas 98 x 142" (248.9 x 360.7 cm)

Jean Dubuffet "Les lieux conjugés", 1976

Acrylic and paper collage on canvas 97-1/2" x 98" (248 cm x 249 cm)

Jean Dubuffet Panorama, January 20, 1978

Acrylic and paper collage on canvas 82-1/2" x 111-1/2" (209.6 cm x 283.2 cm)

Jean Dubuffet La féconde journée, 1976

Acrylic and paper collage on canvas 80-1/2" x 83" (204.5 cm x 210.8 cm)

All images are from the Pace Wildenstein website and used without permission.

Space, the Final Frontier

The Beginning of Time: String Theory

I've been reading The Elegant Universe, Brian Greene's wonderful book on string theory. A quick description quoted from the publishers comments on the back cover:

This was my third reading and each time I came away with a deeper insight of quantum theory and a sense of awe that mankind can even conceive of such a far reaching theoretical description of the universe. The universe as something as opposed to nothing, not just a universe of stars, but corporeality itself.

At the beginning of the last century physics was relatively simple, matter was viewed in a way similar to the Greek concept of atoms. Of course scientists, being a curious lot, found a way to break apart the atom into smaller particles, neutrons, protons and electrons, but it didn’t stop there and particle smashing became a part of experimental physics for the next century.

As one might suspect, experimental physicists kept finding more and more subatomic particles, the little pieces which made up the atomic particles, quarks, muons… and things became complicated rather quickly. Up to this point we are still using a model we can easily visualize by playing around with some styrofoam balls. Consider the photon, the particle for light, and everything goes awry. Light sometimes behaves like a waveform, this can be verified by experiment but it is also can be viewed as a particle which also can be tested by experiment. In 1927, Werner Heisenberg and Niels Bohr proposed the Uncertaity Principle which in essence states that you cannot measure properties which define both states at the same time. Things are now starting to become interesting, as these chameleon like properties, become evident only when viewed statistically, sometimes they are here, sometimes they are there, but if you measure them, you freeze a particular state.

Richard Feynman was awarded the Nobel Prize for physics for his work on Quantum electrodynamics which offers a solution to the problem above by suggesting that light takes all possible paths to its destination and what the scientist observes is the statistical sum of all of them. Right about here one has to leave a common sense world view behind, welcome to quantum physics. As counter-intuitive this seems in a Newtonian world view , it was a theory which helped make, among other things, the transistor possible. However, in spite of the early achievements in quantum theory, there were several unexplained questions and all the macro-micro views did not all quite fit together, in particular Gravity was problematic. In physics, one often finds big theoretical problems are caused by mathematical solutions which give "undefined" results, like dividing a number by zero. Infinity is the bane of the mathematical theorist. For example, when a star collapses into a black hole its density, mass/volume, which might shrink to zero, becomes infinite. While this may not be precisely correct, it does describe one of the problems which occurs when trying to formulate an all inclusive quantum theory, the holy grail of physics, the TOE, the theory of everything.

Enter string theory

Brian Green picks it up from there, leading the reader through the historical developments as well as the mind boggling mathematical and conceptual constructs which make string theory a viable possibility for a TOE.

String theory, or M-Theory as it is now called, is an appealing conceptualization which piqued my interest in several areas. For one, a string, as far as I can understand, isn't anything at all. It is not really a "thing" or made of something, rather it is a vibration in space, if it ceases to vibrate, like a guitar string it is silent, it ceases to exist. If it vibrates, it possess energy and since energy and matter are related, it becomes something.

In order to keep the bookkeeping straight, eliminate those pesky infinities and to unify all the forces including gravity, Edward Witten and others proposed an 11 dimensional space to contain reality as we know it. The expanded dimensions, three space dimensions, plus the time dimension are what we experience, the other seven dimensions are described as being "curled up", or super small. Visualizing 11 dimensions is wickedly difficult, the mathematicians can describe them mathematically, but trying to visualize them is more or less impossible. I think it is possible to understand their implications, they allow the strings to exist and as such they allow the world to exist.

So I asked myself, what was there before the big bang? Nothing? I like the idea of nothing. So suppose we have nothing, by nothing I mean nothing, no space, no time, nothing. "Let there be space" and there was space. The will of a supreme being, or just chance, that is all it would take, because once there is space, everything else follows. Since strings require space, but are not made from space, they just vibrate in space, the shock of the initial creation of space sets everything into vibration, the vibration creates energy and matter, and must expand. Something from nothing, it's a start, the grand inflation leading to the separation of the primary forces, gravity and matter, it is all just space buzzing at one frequency or another. What a grand idea.

I've been reading The Elegant Universe, Brian Greene's wonderful book on string theory. A quick description quoted from the publishers comments on the back cover:

"In a rare blend of scientific insight and writing as elegant as the theories it explains, Brian Greene, one of the worlds leading string theorists, and author of the forthcoming the Fabric of the Cosmos, peels away layers of mystery surrounding string theory to reveal a universe that consists of eleven dimensions, where the fabric of space tears and repairs itself and all matter - from the smallest quarks to the most gargantuan supernova - is generated by the vibrations of microscopically tiny loops of energy.

This was my third reading and each time I came away with a deeper insight of quantum theory and a sense of awe that mankind can even conceive of such a far reaching theoretical description of the universe. The universe as something as opposed to nothing, not just a universe of stars, but corporeality itself.

At the beginning of the last century physics was relatively simple, matter was viewed in a way similar to the Greek concept of atoms. Of course scientists, being a curious lot, found a way to break apart the atom into smaller particles, neutrons, protons and electrons, but it didn’t stop there and particle smashing became a part of experimental physics for the next century.

As one might suspect, experimental physicists kept finding more and more subatomic particles, the little pieces which made up the atomic particles, quarks, muons… and things became complicated rather quickly. Up to this point we are still using a model we can easily visualize by playing around with some styrofoam balls. Consider the photon, the particle for light, and everything goes awry. Light sometimes behaves like a waveform, this can be verified by experiment but it is also can be viewed as a particle which also can be tested by experiment. In 1927, Werner Heisenberg and Niels Bohr proposed the Uncertaity Principle which in essence states that you cannot measure properties which define both states at the same time. Things are now starting to become interesting, as these chameleon like properties, become evident only when viewed statistically, sometimes they are here, sometimes they are there, but if you measure them, you freeze a particular state.

Richard Feynman was awarded the Nobel Prize for physics for his work on Quantum electrodynamics which offers a solution to the problem above by suggesting that light takes all possible paths to its destination and what the scientist observes is the statistical sum of all of them. Right about here one has to leave a common sense world view behind, welcome to quantum physics. As counter-intuitive this seems in a Newtonian world view , it was a theory which helped make, among other things, the transistor possible. However, in spite of the early achievements in quantum theory, there were several unexplained questions and all the macro-micro views did not all quite fit together, in particular Gravity was problematic. In physics, one often finds big theoretical problems are caused by mathematical solutions which give "undefined" results, like dividing a number by zero. Infinity is the bane of the mathematical theorist. For example, when a star collapses into a black hole its density, mass/volume, which might shrink to zero, becomes infinite. While this may not be precisely correct, it does describe one of the problems which occurs when trying to formulate an all inclusive quantum theory, the holy grail of physics, the TOE, the theory of everything.

Enter string theory

In 1968, theoretical physicist Gabriele Veneziano was trying to understand the strong nuclear force when he made a startling discovery. Veneziano found that a 200-year-old formula created by Swiss mathematician Leonhard Euler (the Euler beta function) perfectly matched modern data on the strong force. Veneziano applied the Euler beta function to the strong force, but no one could explain why it worked.

In 1970, Yoichiro Nambu, Holger Bech Nielsen, and Leonard Susskind presented a physical explanation for Euler's strictly theoretical formula. By representing nuclear forces as vibrating, one-dimensional strings, these physicists showed how Euler's function accurately described those forces.

Brian Green picks it up from there, leading the reader through the historical developments as well as the mind boggling mathematical and conceptual constructs which make string theory a viable possibility for a TOE.

String theory, or M-Theory as it is now called, is an appealing conceptualization which piqued my interest in several areas. For one, a string, as far as I can understand, isn't anything at all. It is not really a "thing" or made of something, rather it is a vibration in space, if it ceases to vibrate, like a guitar string it is silent, it ceases to exist. If it vibrates, it possess energy and since energy and matter are related, it becomes something.

In order to keep the bookkeeping straight, eliminate those pesky infinities and to unify all the forces including gravity, Edward Witten and others proposed an 11 dimensional space to contain reality as we know it. The expanded dimensions, three space dimensions, plus the time dimension are what we experience, the other seven dimensions are described as being "curled up", or super small. Visualizing 11 dimensions is wickedly difficult, the mathematicians can describe them mathematically, but trying to visualize them is more or less impossible. I think it is possible to understand their implications, they allow the strings to exist and as such they allow the world to exist.

So I asked myself, what was there before the big bang? Nothing? I like the idea of nothing. So suppose we have nothing, by nothing I mean nothing, no space, no time, nothing. "Let there be space" and there was space. The will of a supreme being, or just chance, that is all it would take, because once there is space, everything else follows. Since strings require space, but are not made from space, they just vibrate in space, the shock of the initial creation of space sets everything into vibration, the vibration creates energy and matter, and must expand. Something from nothing, it's a start, the grand inflation leading to the separation of the primary forces, gravity and matter, it is all just space buzzing at one frequency or another. What a grand idea.

Tuesday, May 09, 2006

Bids Breakup Blakes

In an earlier post I expressed my dismay over Sotheby's decision to sell the recently discovered suite of William Blake drawings separately because it was highly unlikely the nineteen drawings would be kept together. The sale was held on May 2, 2006 and as everyone expected the set of drawings was indeed broken up.

So how dideveryone the money people do? In typical bean counter fashion here is a spreadsheet with the final results.

Now all the cards are on the table, from both a business and PR standpoint it would appear to me that since 40% of the offered lots were bought in, Sotheby's probably would have done better if they had insisted on selling the drawings as a group. (I must admit I know nothing of the backroom antics, certainly the speculator who owned the drawings wanted to realize the highest price possible, so…)

I would also note that of the 19 lots, only 5 (26%) were sold at, or above the presale low estimate. (The presale estimates do not include the "buyers premium" but the reported sales price does, so I Calculated a "Gavel Price" with no premium for the comparisons.) The speculators, who offered the Blake drawings for sale, are probably happy. It appears they have made back close to their original investment and still own eight of the drawings which they can peddle piecemeal to realize a profit on the bet. Business is business.

I suspect the sale probably was a bit of a disappointment for Sotheby's. After an initial buying frenzy, it appears the bidders felt that even the presale low estimates were a bit off the mark and became more cautious about raising the paddle. Or, the auction market is starting to soften, and the results from the sale of the Blake drawings are the first indication this may be the case. (… I know, Picasso and Van Gogh, but later on that…)

So how did

Now all the cards are on the table, from both a business and PR standpoint it would appear to me that since 40% of the offered lots were bought in, Sotheby's probably would have done better if they had insisted on selling the drawings as a group. (I must admit I know nothing of the backroom antics, certainly the speculator who owned the drawings wanted to realize the highest price possible, so…)

I would also note that of the 19 lots, only 5 (26%) were sold at, or above the presale low estimate. (The presale estimates do not include the "buyers premium" but the reported sales price does, so I Calculated a "Gavel Price" with no premium for the comparisons.) The speculators, who offered the Blake drawings for sale, are probably happy. It appears they have made back close to their original investment and still own eight of the drawings which they can peddle piecemeal to realize a profit on the bet. Business is business.

I suspect the sale probably was a bit of a disappointment for Sotheby's. After an initial buying frenzy, it appears the bidders felt that even the presale low estimates were a bit off the mark and became more cautious about raising the paddle. Or, the auction market is starting to soften, and the results from the sale of the Blake drawings are the first indication this may be the case. (… I know, Picasso and Van Gogh, but later on that…)

Sunday, April 30, 2006

Rolling Stone stones Bush

At the risk of preaching to the converted, I would suggest reading "The Worst President in History?" by Sean Wilnetz in the Rolling Stone Wilnetz leads off with the line

What appalls me is that the voters of this country, allegedly elected him twice.

Late breaking update: Rumor has it that the private fund raising for a George W. Bush "presidential library" has run into difficulties as his NeoCon supporters have decided that a book burning to destroy the evidence would be a better option instead.

"George W. Bush's presidency appears headed for colossal historical disgrace…"followed by

Now, though, George W. Bush is in serious contention for the title of worst ever. In early 2004, an informal survey of 415 historians conducted by the nonpartisan History News Network found that eighty-one percent considered the Bush administration a "failure."It just gets worse from there, another tidbit…

"Armed with legal findings by his attorney general (and personal lawyer) Alberto Gonzales, the Bush White House has declared that the president's powers as commander in chief in wartime are limitless. No previous wartime president has come close to making so grandiose a claim. More specifically, this administration has asserted that the president is perfectly free to violate federal laws on such matters as domestic surveillance and the torture of detainees. When Congress has passed legislation to limit those assertions, Bush has resorted to issuing constitutionally dubious "signing statements," which declare, by fiat, how he will interpret and execute the law in question, even when that interpretation flagrantly violates the will of Congress. [emphasis added]

What appalls me is that the voters of this country, allegedly elected him twice.

Late breaking update: Rumor has it that the private fund raising for a George W. Bush "presidential library" has run into difficulties as his NeoCon supporters have decided that a book burning to destroy the evidence would be a better option instead.

Friday, April 28, 2006

Irony I'm home.

Edna has written what I feel is an important observation on the contemporary use of irony in art. What prompted her commentary was Jerry Saltz review in the Village Voice of Amy Sillman's current exhibition at the Sikkema Jenkins Gallery. I took the time to go see this exhibition of paintings this afternoon. Although I will make some personal observations on Ms Stillman's paintings what also interested me were Edna's observations about irony and how it's pervasive use might be distorting our current perceptual approaches towards art.

To her credit Edna doesn't mince words and starts off describing the problem bluntly.

This is a poignant observation. If an artist looks to the past, or any other source, for inspiration, for guidance or a place to start an investigation, must this position be viewed as ironic because of its reference? While one may or may not intend such a reference to be read as ironic, certainly one cannot assume that all references are necessarily ironic. Aside from just a point of departure, a reference may also be used, without irony, as a mode of content by addressing the viewers memory or awareness of a particular context. To ascribe irony to these other frameworks strips them of their true meaning and potentiality. It is one possible point of view but not the only point of view.

Another astute observation. Irony in itself is interesting. Unfortunately, instead of an insightful contrast or dislocation, often wearing the cloak of humor, irony has become an excuse for artworks of questionable quality instead of raising a thoughtful criticism of their potential weakness

Dead on the money.

Jerry Saltz makes the observation that "There are still no memorable images in the eight paintings in her current show..." [Saltz, Village Voice]

Edna counters with several questions.

I am not sure that "fresh, pertinent or up to date," are qualities necessary for a "memorable image." Certainly they may be qualities possessed by a memorable image but over time these references fade and we are left to deal with the paintings as they are in some future historical moment. In this respect I would agree with Edna's observations. Certainly the application of "irony," regressive or otherwise cannot guarantee a "memorable image." To Saltz defense, he tries to infer what he means by "memorable image" by making comparisons to other paintings. The difficulty here, for the reader, is in the misreading of the inference that one style or another might possess the secret.

The problem is that language is ill equipped to define the requirements for a "memorable image." In particular because the qualities of a "memorable image" are not linguistically defined but experiential. The recent Fra Angelico exhibition at the Met is a case in point. These were terrific paintings, memorable images. In spite of the fact, for most viewers, the linguistic or symbolic meanings are not immediately accessible, the paintings still move us. We have an emotional experience, a positive response, we like it or we don't based solely on what we experience visually. Five hundred years after their creation, we are bringing an entirely new viewing context to these paintings and potentially we still can have a meaningful experience.

I suspect the overuse of "irony" is another passing fad. The "wink wink nod nod insider joke" was a useful marketing tool but when everyone has one, what good is it for distinguishing one brand from another? Ironically, critical analysis should view irony as irony but also directly address other critical issues without allowing "irony" to function as an excuse for weakness in these other areas.

Finally, I want to return to Amy Stillman's paintings and the "memorable image" question as it is directly applied to her recent exhibition. There is a difficult to define quality I would use for a memorable image. The term I use is "presence" An analogy for the experience would be the awareness of a particular person who walks into a room and holds your attention. Marilyn Monroe on the silver screen (yup, I'm over 40)

What gives a painting presence? While any of the intellectual, conceptual or symbolic attributes may be part of the issue, as I described above with Fra Angelico, they are not necessarily a requirement. Neither is color, scale, or technical facility, although any of these may also contribute to the quality.

Presence occurs because the painting exists as an ontological object. It is a self contained definition of itself which does not require outside mediation for completion. Experientially, one feels the painting is insistent of itself. It declares its identity as singular and actively present in the real world of objects. When a painting has presence it holds your attention.

Presence is a quality inherently in the painting, or not. With some radical paintings it may not be perceived by all viewers but if it is there it is there. It cannot be added on by critical discourse after the fact, it has it or it doesn't. To confuse the issue I would accept that there are varying degrees of presence but what I am most interested in is "insistent presence," the case where you know you are in the "presence of."

In the case of Amy Sillman's new paintings, I somewhat agree with Jerry Saltz. I am a fairly generous observer and I thought she had a good exhibition. I liked the paintings. From my point of view, I don't think the issue of "irony" is applicable to her work at all. Sillman's paintings seem like they are an honest personal investigation of how one can make a painting. Where I think some of the paintings might be problematic is that they did not seem to have a sufficient enough presence to overcome just looking like good paintings. What I mean by this is that there is a disjunct between the image of the painting and the painting itself. By image, I mean how the whole painting appears, the "picture of itself." This may sound contradictory but "the picture" is like what you see in a jpeg, the image of the painting. This must be coincident with the experience of the physical painting itself. More attention paid to edges might be a potential solution to this issue.

Of the group, the painting in the front named "The Plumbing" was the most memorable for me.

Lets be pedantic about it, irony:

1. The use of words to express something different from and often opposite to their literal meaning.

2. An expression or utterance marked by a deliberate contrast between apparent and intended meaning.

3. A literary style employing such contrasts for humorous or rhetorical effect.

To her credit Edna doesn't mince words and starts off describing the problem bluntly.

"You're basically doomed because irony has fucked up your sense of what is legitimate investigation and how to communicate it honestly once you find your groove."

This is a poignant observation. If an artist looks to the past, or any other source, for inspiration, for guidance or a place to start an investigation, must this position be viewed as ironic because of its reference? While one may or may not intend such a reference to be read as ironic, certainly one cannot assume that all references are necessarily ironic. Aside from just a point of departure, a reference may also be used, without irony, as a mode of content by addressing the viewers memory or awareness of a particular context. To ascribe irony to these other frameworks strips them of their true meaning and potentiality. It is one possible point of view but not the only point of view.

"The inroad to irony is so internalized that it manifests itself as compulsory abjectness."

Another astute observation. Irony in itself is interesting. Unfortunately, instead of an insightful contrast or dislocation, often wearing the cloak of humor, irony has become an excuse for artworks of questionable quality instead of raising a thoughtful criticism of their potential weakness

It's a mannerism.

Dead on the money.

Jerry Saltz makes the observation that "There are still no memorable images in the eight paintings in her current show..." [Saltz, Village Voice]

Edna counters with several questions.

"Memorable images. Are they really not memorable, or are they just subtle in a way that doesn't register as fresh or clued-in, i.e. pertinent?"

"Is the feeling of something when the thing itself is out of reach, and the images can't present themselves in any totality, really out of date?"

"Isn't it a slower, more in-depth investigation; the opposite of the forced, quotation-like narrative we've come to define as clever?"

I am not sure that "fresh, pertinent or up to date," are qualities necessary for a "memorable image." Certainly they may be qualities possessed by a memorable image but over time these references fade and we are left to deal with the paintings as they are in some future historical moment. In this respect I would agree with Edna's observations. Certainly the application of "irony," regressive or otherwise cannot guarantee a "memorable image." To Saltz defense, he tries to infer what he means by "memorable image" by making comparisons to other paintings. The difficulty here, for the reader, is in the misreading of the inference that one style or another might possess the secret.